Editor’s note: This dossier was produced by a Ukrainian investigative journalist Nadiya Burdey for the Anti-Corruption Action Center. The Ukrainian version was published by Ukrainska Pravda. This is the first of an upcoming series of stories on the trusted persons of Ukrainian oligarchs produced by the Pep.org.ua project of the Anti-Corruption Action Center.

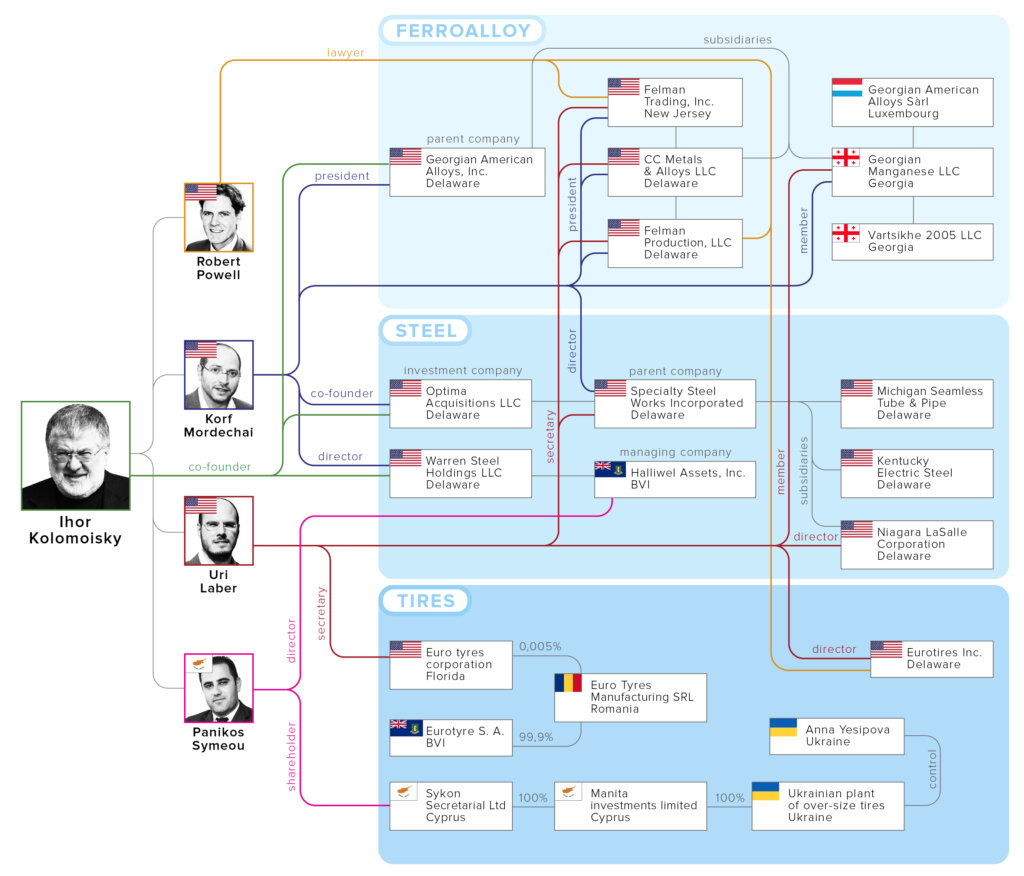

Ihor Kolomoisky is a Ukrainian oligarch and the former governor of Dnipropetrovsk Oblast. He owns media, steelmaking, ferroalloy, oil and gas assets, as well as luxury real estate, water terminals, and airplanes. All of these assets are part of the informal Privat business group controlled by him and business partner, Gennadiy Bogolyubov. Due to ongoing court cases, the assets are now partially frozen.

- Get the newest Ukraine news reports as of today.

- See the most recently published Ukraine news reports from today.

However, the freeze was imposed only on those assets directly registered to the billionaire or involved in an a series of alleged schemes to withdraw $5.5 billion dollars from PrivatBank, the country’s largest financial institution.

Other Kolomoisky assets are hidden in offshore or registered on trusted individuals.

Law enforcement agencies aren’t the only ones who want to see the ownership structures of Kolomoisky’s companies. His former business partners are also curious.

Businessman Vadym Shulman has been pursuing Kolomoisky in court since 2015. Earlier, in 2014, another oligarch, Victor Pinchuk, engaged in litigation with Kolomoisky and accused him not only of appropriating his business, but even of murder.

Shulman and Pinchuk are demanding that the ownership structure of the long list of companies registered in offshore jurisdictions be disclosed. These companies own real estate, steel and ferroalloy plants in the United States and Georgia.

None of these companies is directly registered to Kolomoisky. But all of them have common managers, lawyers, and even addresses. According to both businessmen’s lawsuits, they are all controlled by Kolomoisky.

The same group of managers run not only these companies, but also several groups of firms involved in the PrivatBank case.

Who are these people?

TRUSTED PERSON № 1: Panikos Symeou

Panikos Symeou is the managing partner of the Cypriot law firm Symeou & Konnaris LLC. According to its website, this company highly values privacy and trust.

Fugitive Ukrainian businessmen like oligarch Serhiy Kurchenko and former National Bank head Serhiy Arbuzov apparently also appreciate these qualities. Panikos Symeou was the head of their Cypriot firm Sabulong Trading, LTD.

In 2017, this company was among the offshore companies that the Prosecutor General’s Office of Ukraine confiscated $1.3 billion from. They had been stolen from the country by the criminal organization created by ousted former Ukrainian President Viktor Yanukovych.

Ihor Kolomoisky entrusts Panikos Symeou with a much wider list of assets — for example, media, steel factories, tire production companies and water terminals.

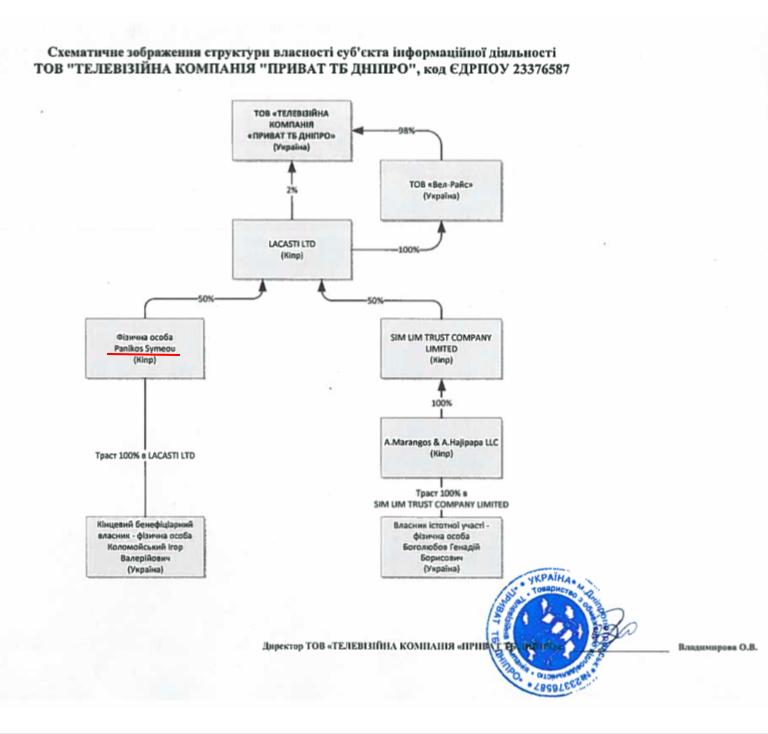

Symeou’s role is very clear in the ownership structure of Dnipropetrovsk television channel Pryvat TV Dnipro (Channel 9). Symeou is the trusted individual through whom Kolomoisky owns the channel.

Steel business in the US

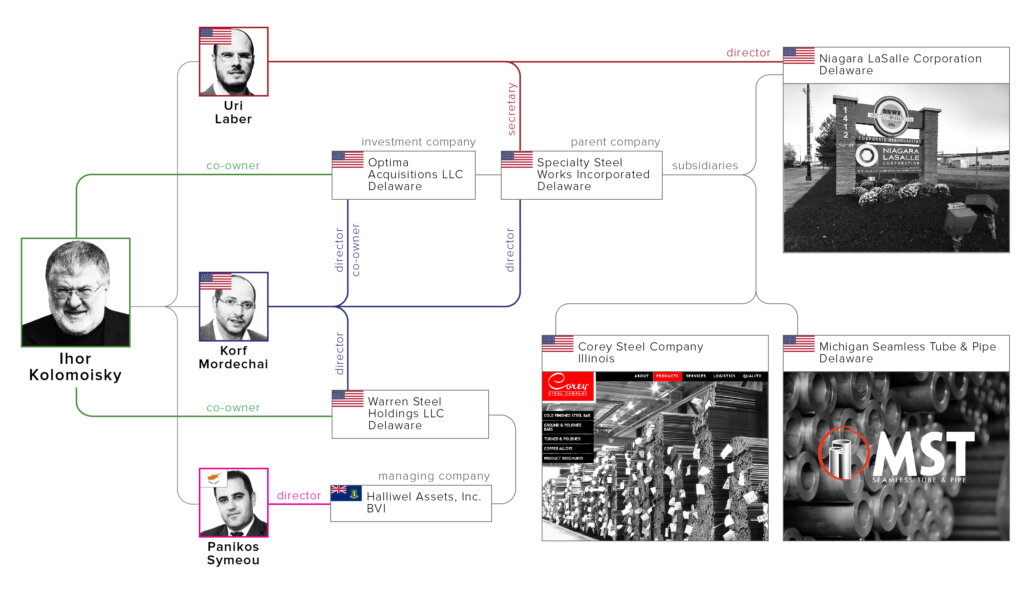

Panikos Symeou also has a clear role in the ownership structure of steel factory Warren Steel Holdings LLC in the state of Ohio. The company is nominally registered to the offshore firm Halliwel Assets, Inc in the British Virgin Islands. But, in 2015, one of owners of the factory disclosed the names of all its beneficiaries in court.

According to case materials, the factory belongs to three Ukrainian businessmen: Vadym Shulman, Bogolyubov and Kolomoisky. The latter controls the factory through Symeou.

Shulman initiated that court case. In 2001, he bought the derelict factory and relaunched it. Then, in 2006, Bogolyubov and Kolomoisky became its co-owners.

In 2012, Schulman said he began to suspect his partners of fraud. During his own investigation, he discovered that Warren Steel had concluded loan agreements and sales contracts with other companies controlled by Kolomoisky and Bogolyubov on conditions that were unprofitable for the factory.

According to Shulman, his partners burdened the factory with debts to their own companies in order to receive full control over the assets of Warren Steel.

Shulman’s hypothesis was confirmed in August 2014 when Kolomoisky’s representative, Panikos Symeou, agreed to another $25-million loan for Warren Steel Holdings from the company Optima Acquisitions, LLC. That company was also controlled by Kolomoisky, Shulman said. The media repeatedly reported this without providing any evidence.

In 2015, Shulman filed suit against Warren Steel Holdings, LLC, Panikos Symeou, the company Halliwel Assets, Inc and the president of the Warren Steel factory Mordechai Korf.

TRUSTED PERSON № 2: Mordechai Korf

Mordechai Korf is Ihor Kolomoisky’s American business partner and the director of his multiple steel and manganese enterprises in the United States. In particular, Korf was not only the president of the Warren Steel factory, but also the co-owner of Optima Acquisitions LLC, which gave loans to the factory.

Optima Acquisitions is an investment company registered in Delaware, a state that does not disclose firms’ beneficiaries. Korf has run this company since 2008. Optima Acquisition also owns another American company, Optima Specialty Steel, Inc., which owns several steel factories in various U.S. states.

Journalists have previously tied the name Kolomoisky to the Optima group of companies, but this connection was only confirmed during Optima Specialty Steel’s bankruptcy case. According to case materials, Korf, Kolomoisky and Bogolyubov each owned 33 percent of Optima Acquisitions LLC in 2017.

At the end of 2017, Optima Specialty Steel completed its plan of reorganization (bankruptcy) and was rebranded as Specialty Steel Works, Inc. The corporate agent was changed as well as the entire leadership of the company.

In an official press release, the company stated that it would continue to manufacture and sell steel products through its four wholly-owned subsidiaries: Michigan Seamless Tube & Pipe, the Niagara LaSalle Corporation, the Corey Steel Company and Kentucky Electric Steel. Each of these companies owns a factory in the United States.

Michigan Seamless Tube & Pipe predictably owns a factory located in Michigan. The company manufactures seamless cold-drawn pipes for the aerospace, mining, construction, automotive and agricultural industries.

The Niagara LaSalle Corporation owns a factory that manufactures steel parts for automotive, construction, and agricultural machinery in Indiana.

The Corey Steel Company’s factory is located in Cicero, Illinois. It manufactures steel bars.

At the end of 2018, another American company, Steel Dynamics, Inc., acquired Kentucky Electric Steel.

Kolomoisky’s tires

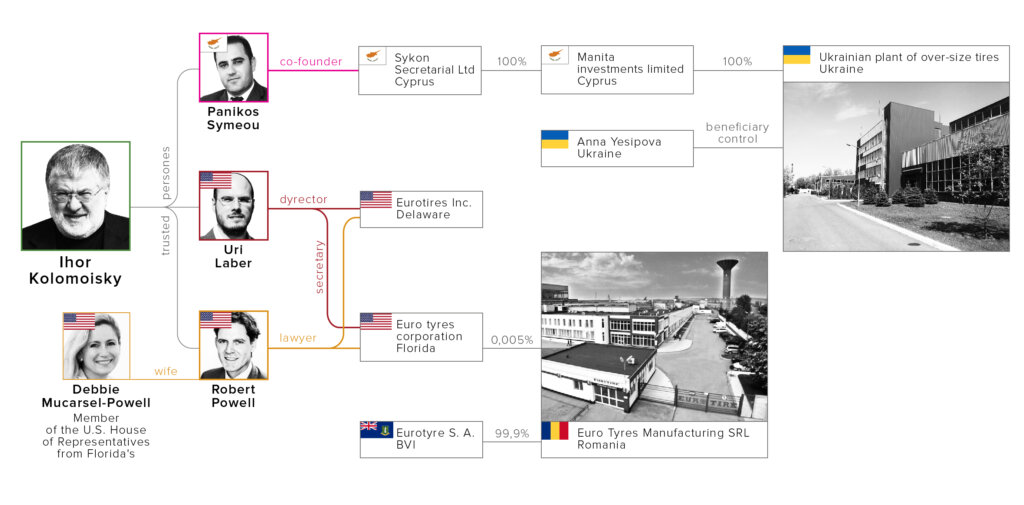

In Ukraine, the name Panikos Symeou is not only connected with the business structures of Kurchenko and Kolomoisky’s Dnipro television channel. The Cypriot is also the co-owner of a Ukrainian plant for producing oversized tires through the company Manita Investments Limited.

The beneficiary controller of the tire plant is Dnipro resident Anna Yesipova. One hundred percent of the plant’s shares is the Cypriot company Manita. It, in turn, is owned by another Cypriot company Sykon Secretarial Limited. Fifty percent of the latter belongs to Panikos Symeou.

The Ukrainian Factory of Oversized Tires and a Romanian factory operate under the same brand name and have one website. An excerpt from the State Register of Romania contains the address of company Euro Tyres Manufacturing SRL’s website: www.eurotire.net. The same website also contains the address of the Ukrainian branch, the Ukrainian Factory of Oversized Tires, that owns factory premises.

Therefore, according to the Eurotire website, the factory is part of a large international corporation which manufactures oversized tires for Eurotire’s mining equipment. The representative offices of this company are located in the United States, Kazakhstan, Indonesia, the Philippines, Japan, Ukraine and Russia. The factories that manufacture such tires are only located in Ukraine and Romania.

In particular, the corporation supplied tires for the company Ferrexpo PLC in Ukraine, which is controlled by Ukrainian dollar billionaire Kostyantyn Zhevago. Ferrexpo PLC owns the Ukrainian Poltava Mining and Processing Plant OJSC, which mines iron ore.

EuroTire’s advertising video states the company cooperates with Ferrexpo PLC.

According to a report published on the Euro Tyres website, more than $300 million were invested in this factory in 2007.

As of March 15, 2019 the owner of the factory is the Romanian company Euro Tyres Manufacturing SRL. This company belongs to two other offshore companies: EuroTyre S.A from the British Virgin Islands and the American Euro Tyres Corporation.

But Panikos Symeou is not the only person who ties Kolomoisky to the international Eurotire corporation. There are also two other links. One of them is the oligarch’s business partner, Uri Laber.

TRUSTED PERSON №3: Uriel Tzvi Laber

Uriel Tzvi Laber is an American who has been actively developing business in Ukraine since the 1990s. Laber is especially interested in oil. During 1997-1999, he founded two fuel companies, Mavex LLC and Petroleum-Invest, LLC.

And, in 2010, Laber became a member of the Supervisory Board of Ukrnafta PJSC. As of March 11, 2019, he still holds this position. Laber is also the director of the American company Optima International of Miami, Inc. According to Bloomberg, this company manufactures tires and is s subsidiary of CB PrivatBank PJSC.

And, of course, Laber himself is director of the Eurotire group of companies.

The connections between Eurotire and Kolomoisky don’t stop there. The Ukrainian and offshore Eurotire companies are involved in PrivatBank-related cases.

As of 2019, the Ukrainian plant for producing over-sized tires is the subject of criminal proceeding by the National Anti-Corruption Bureau of Ukraine over the embezzlement of money from CB Privatbank PJSC, allegedly committed by the management and owners of a substantial part of the bank. Prior to the bank’s nationalization in 2016, one of its co-owners was Igor Kolomoisky.

The Ukrainian plant for producing over-sized tires received a loan in the amount of several million dollars from PrivatBank and did not return the money. When the National Bank uncovered problems inside PrivatBank and Kolomoisky committed to restructure its loan portfolio, employees of the bank transferred the debt from 193 existing companies to non-operating, newly-created companies, which did not have sufficient funds to service the loans. In particular, the debts of actually existing assets — like the the oversized tire plant, were transferred to a newly-created company.

Another offshore company, British Virgin Islands-registered Eurotyre S.A., which owns 99 percent of the factory in Romania, is connected to another embezzlement scheme

According to case materials, PrivatBank officials and owners created a criminal organization and, in 2008-2015, withdrew Hr 12,5 billion ($478 million) in the form of loans to 15 Ukrainian companies. Instead of mortgages, these companies transferred contracts for paid goods to the bank.

So in 2014, Ukrainian company Mondial, LLC concluded an agreement with the non-resident Eurotyre S.A. for the purchase of 21,000 tons of natural rubber for $77 million. This contract was created in the form of a mortgage which Mondial transferred to PrivatBank when it received the loan. Therefore, the company Eurotyre S.A. is obliged to transfer rubber worth $77 million to the bank.

In February 2019, the Pechersk District Court of Kyiv granted the Prosecutor General’s Office access to the contract and a number of other documents located at the office of Eurotyre S.A (Vanterpool Plaza, P.O. Box 873, Wickhams Cay I Road, Road Town, Tortola, British Virgin Islands).

The court granted access to documents in criminal proceeding No. 42017000000001823 as of June 6, 2017 “on the fact of creating a criminal organization, as well as operating such an organization and participation in it in order to obtain the cash funds of CB PrivatBank PJSC in especially large volumes during 2008-2016 by former officials of CB PrivatBank PJSC.”

The court’s decision states that former PrivatBank officials involved “owners and managers of a number of business entities, as well as representatives and final beneficiaries of a number of foreign companies that are connected to the bank through individuals” in order to bring the bank to insolvency.

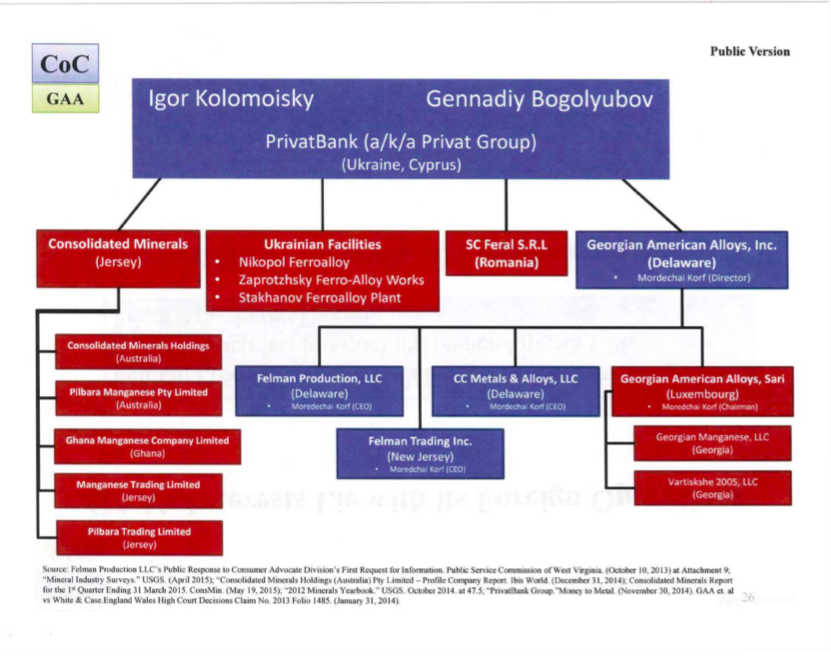

Kolomoisky’s silico-manganese industry

Kolomoisky’s partners Korf and Laber also operate the oligarch’s ferroalloy business in the U.S. and Georgia.

In 2015, Ukrainian oligarch Viktor Pinchuk pursued Ihor Kolomoisky in the High Court of London.

Pinchuk stated that, in the mid-2000s, he gave Kolomoisky and Bogolyubov money for the purchase of one of the largest iron ore mining companies in Ukraine. But he received neither the company, nor money from them. Pinchuk estimated the profit lost during all these years at $2 billion.

But in January 2016, a few days before court hearing, Pinchuk, Kolomoisky and Bogolyubov reached a peace deal: Kolomoisky pledged to give part of the money from the ferroalloy business to Pinchuk.

The ferroalloy holding includes the Nikopol, Zaporizhzhya and Stakhaniv ferroalloy factories and the Marganets and Ordzhonikidze mining and concentrating combines in Dnipropetrovsk region. In fact, none of these Ukrainian ferroalloy enterprises belong to either Pinchuk or Kolomoisky.

In 2016, the United States International Trade Commission (USITC) published a presentation on the import of silico-manganese. The report also contains a list of Ukrainian ferroalloy factories. According to the Commission, these companies are controlled by Kolomoisky and Bogolyubov. The report also contains a list of the oligarchs’ other ferroalloy assets located in the United States, Georgia and Australia.

Viktor Pinchuk filed an appeal to a Florida court with a request to disclose the ownership property ownership of Georgian American Alloys, Inc. (Delaware), CC Metals and Alloys, LLC (Delaware), Felman Production, LLC (Delaware), and Felman Trading, Inc. (New Jersey). Although these companies are formally registered in offshore jurisdictions and, accordingly, the companies’ owners are not visible, the directors of all these companies were and remain Kolomoisky’s partners Korf and Laber.

Another manager of the companies Felman Production, LLC, Felman Trading, Inc., and the Euro Tyres Corporation is Robert Powell, the husband of Florida Democratic Representative Debbie Mucarsel-Powell.

In the November 2018 midterm election, Debbie Powell won her seat in the U.S. House of Representatives. That same year, the The Miami Herald reported that the Democrat’s husband had been working as the general lawyer in companies controlled by Ihor Kolomoisky for over 10 years. Robert Powell has earned $695,000 while working for these companies in the past two years.

- “I have never worked for, represented…or received any payments from Kolomoisky,” Powell stated during his wife’s campaign.

Mordechai Korf confirmed the statement. He said that Powell concluded his contracts and that he did not have any direct relationship with Kolomoisky. According to Korf, Powell left the company in 2017.

The Democrat’s husband submitted companies Felman Trading and Robert Powell PA as the source of his income in his latest financial report in 2017.

However, according to Florida’s official register, he signs reports on behalf of Felman Production, LLC even in 2019.

Symeou, Privat, and water terminals

Panikos Symeou and Uriel Laber’s entanglements don’t end with factories and the media. They are also tied to Ukrainian water terminals.

In an interview with the Ekonomichna Pravda news site, Igor Kolomoisky mentioned the Borivazh water terminal a few days before the second round of presidential election. The oligarh stated that former national bank chief Valeriya Gontareva was interested in this asset.

The head of the National Bank allegedly wanted to purchase the terminal for Hr 100 million ($3.8 million) and resell it for Hr 250 million ($9.5 million). That is why, Kolomoisky claims, she conducted the nationalization of Privatbank without any formal grounds. That was a violation of his rights, he alleges.

The American corporate investigations firm Kroll, which looked into PrivatBank before nationalization, has effectively refuted this claim. But in this context, the very mention of the terminal is interesting: it has never formally belonged to the oligarch.

The company Borivazh

According to case materials, the property of three companies — the Black Sea Fuel Terminal, the Illichivsk Sea Fishing Port and Borivazh — was re-registered at an underestimated value to three other controlled companies: Optima Trade, Agroterminal Logistic and Dar Torg.

The founders of Dar Torg are Cypriots Panikos Simeou and his partner Christakis Konnaris.

And wasn’t complete strangers who re-registered the property of all three terminals, which was valued in total at Hr 683 million ($26 million). According to the investigation, Anatoliy Tereshchenko, the 73-year-old head and accountant of Optima Trade, and Volodymyr Kigitov, founder of Black Sea Fuel Terminal PJSC at that time, did the re-registering.

Anatoliy Tereshchenko is no stranger in Kolomoisky’s world. He was officially employed at the company Mavex, which was co-owned by Kolomoisky partner Uriel Tzvi Laber until 2007.

Laber has been a member of the Supervisory Board at Ukrnafta PJSC since 2010. Fifty percent of this enterprise belongs to the state, while the other half is owned offshore and controlled by Kolomoisky.

And, of course, companies from this group — which formally do not belong to Kolomoisky — received hundreds of millions of dollars in loans from PrivatBank when it belonged to the oligarch. Borivazh LLC received more than $120 million. , the money was not returned to the creditor, and the property has already been re-registered to another firm.

Agroterminal Logistic also received a loan. This company has already paid Hr 996 million ($38 million) to the National Bank of Ukraine. But this is only a third of the Hr 3.6 billion ($137.4 million) in debt, according to loan agreement No. 120.

Recently, Ihor Kolomoisky explained that fear motivates him to register all his assets to trusted persons or offshores. He is supposedly afraid to disclose the ownership structures of companies because they could then be appropriated by President Petro Poroshenko. But Kolomoisky started registering businesses in offshores long before Poroshenko’s presidency. He started after 2000, during a period of active privatization.

This publication is the first of an upcoming series of stories on the trusted persons of Ukrainian oligarchs by the pep.org.ua project of the Anti-Corruption Action Center. More information and documents about politically exposed persons and their close associates are available at pep.org.ua.

You can also highlight the text and press Ctrl + Enter