The Euro exchange rate was on a par with the US dollar for a short time on July 12. The last time this occurred was back in December 2002, Reuters and Investing reported. The Euro has lost about 10% of its value since early March, as the chart below shows.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

Source: https://www.xe.com/currencycharts/?from=EUR&to=USD July 13

After the Euro reached parity with the US dollar around midday Kyiv time, the Euro bounced back up, and by 2:00 p.m. it had edged up to 1.0026 per dollar.

Stock markets also fell as investors are worried about the prospects of further tightening of policy by the European Central Bank and the state of the global economy.

Russia’s invasion has caused a massive humanitarian crisis. It is estimated that almost seven million Ukrainians have left the country. The war and blockading of Ukraine’s southern ports by the Russians have disrupted the export of goods such as metals, grain, food, oil, and gas, pushing inflation to levels not seen in decades.

The dollar’s role as the preferred currency for investors has strengthened in recent weeks. The US currency soared to a 20-year high against several other currencies, with the dollar index adding 0.3. Instead, the British pound hit another two-year low, and the yen was close to its weakest level in over two decades.

Why is the Euro losing value?

The euro has become a particularly vulnerable currency, given the war in Ukraine, the impact of soaring gas prices on the regional economy, and the fact that the European Central Bank has lagged behind rivals in raising interest rates.

According to the Director of the economic department of the European Investment Bank, real economic growth within the European Union is expected to fall below 3% in 2022, compared to the 4% forecast given by the European Commission before the war started. Further trade disruptions or increased economic sanctions could plunge the European economy into recession.

The COVID-19 crisis had earlier weakened small businesses in the EU. Companies were slowly moving away from state support when full-scale war came to Ukraine. These businesses now face higher energy prices, reduced trade, and potentially higher financing costs as banks try to avoid risk.

The slowdown in economic growth is particularly noticeable in Poland and Hungary, both neighbors of Ukraine and which are also hosting many Ukrainian refugees. Italy and Germany, which depend heavily on Russian oil and gas, are also feeling the pressure.

The rapid rise in energy costs in Europe is also causing serious concern for investors, as the only pipeline that carries Russian natural gas to Germany has been shut down, allegedly for repairs.

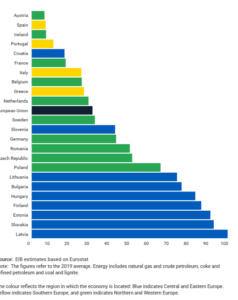

Ten EU countries depend heavily on Russia for their oil and gas.

Share of energy imports outside European Union coming from Ukraine, Russia and Belarus (%).

Source: EIB Ukraine economic shock – June 14

For these countries, the majority of oil and gas imports from outside the EU come from Russia, and dependence on oil and gas for energy production is also higher.

Thus, Russia remains an important supplier to international oil and gas markets and trade disruptions, whether sanctions or similar measures, lead to higher prices.

Higher prices for essential goods increase risk of poverty (%, with increase in percentage points).

Source: EIB Ukraine economic shock – June 14

Reuters adds that the mood of entrepreneurs in the eurozone is deteriorating due to fears about recession. Furthermore, several Chinese cities, including Shanghai, are introducing new COVID-19 restrictions this week to curb outbreaks and this also worries investors.

You can also highlight the text and press Ctrl + Enter