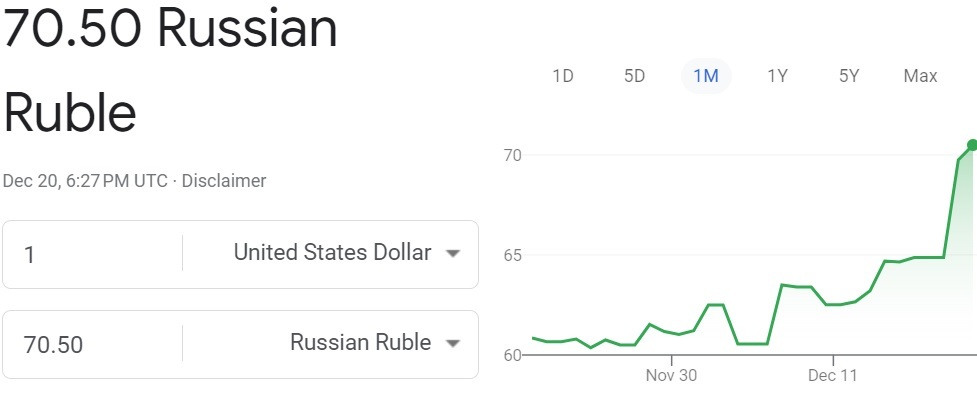

A month ago, when the Russian Ruble (RUB) still traded at 60.85 to the U.S. Dollar (USD), few would have predicted that within just a few short weeks its value would fall to 70.5 to the dollar - representing a loss of nearly 13 percent in value. The rapid change is widely attributed to Russia's falling in oil exports, which were reduced by nearly half in the week since G7 sanctions on Russia's oil took effect.

Yurii, who did not give permission for his real name to be used, is a Russian citizen living in Kyiv who said it was only a few months ago, when mobilization began, that the street value of the Ruble cratered. He told Kyiv Post that his friends back in Russia - and especially in Moscow - know that things are not going well in the Russian economy today - but the official government price is pretty aligned to the prices now found on the black market.

"A few months ago, there was the official exchange rate, and then there is the 'unofficial exchange rate,' that is the black market, where you could get much more realistic prices than what the banks were forced to offer. So, the discrepancy between the bank's rates and the black market rate was around 50 percent more - meaning the competitive value to the dollar that you saw, advertised in the windows of banks, was artificial. It was not backed by anything" said Yurii.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

US Companies Lead Foreign Tax Contributions to Russia, Paying Over $1 Billion

However, to avoid anarchy on domestic currency markets following mobilization and the introduction of international sanctions, Russian Central Bankers acted swiftly and successfully warded off the implosion of the national economy.

Despite a brief spike that saw the Ruble reach 124 to the dollar, bankers were able to introduce currency controls and prevent the economy from hemorrhaging liquidity.

Until the past few weeks, those measures seemed to have been successful in harnessing the Ruble's exchange value.

Now, with new oil price caps and sanctions rolling out from Europe, many business leaders are preparing for Ruble Road to again become a bouncy ride.

Leonid Nevzlin, a Soviet Union-born Israeli businessman and philanthropist said, in reflecting on the jitters caused by the Rubles rapid devaluation, that "If I were a Russian, given the many factors negatively affecting the Russian financial system, I would urgently withdraw almost all Rubles from my bank accounts, and use the resulting cash to buy Dollars or Euros."

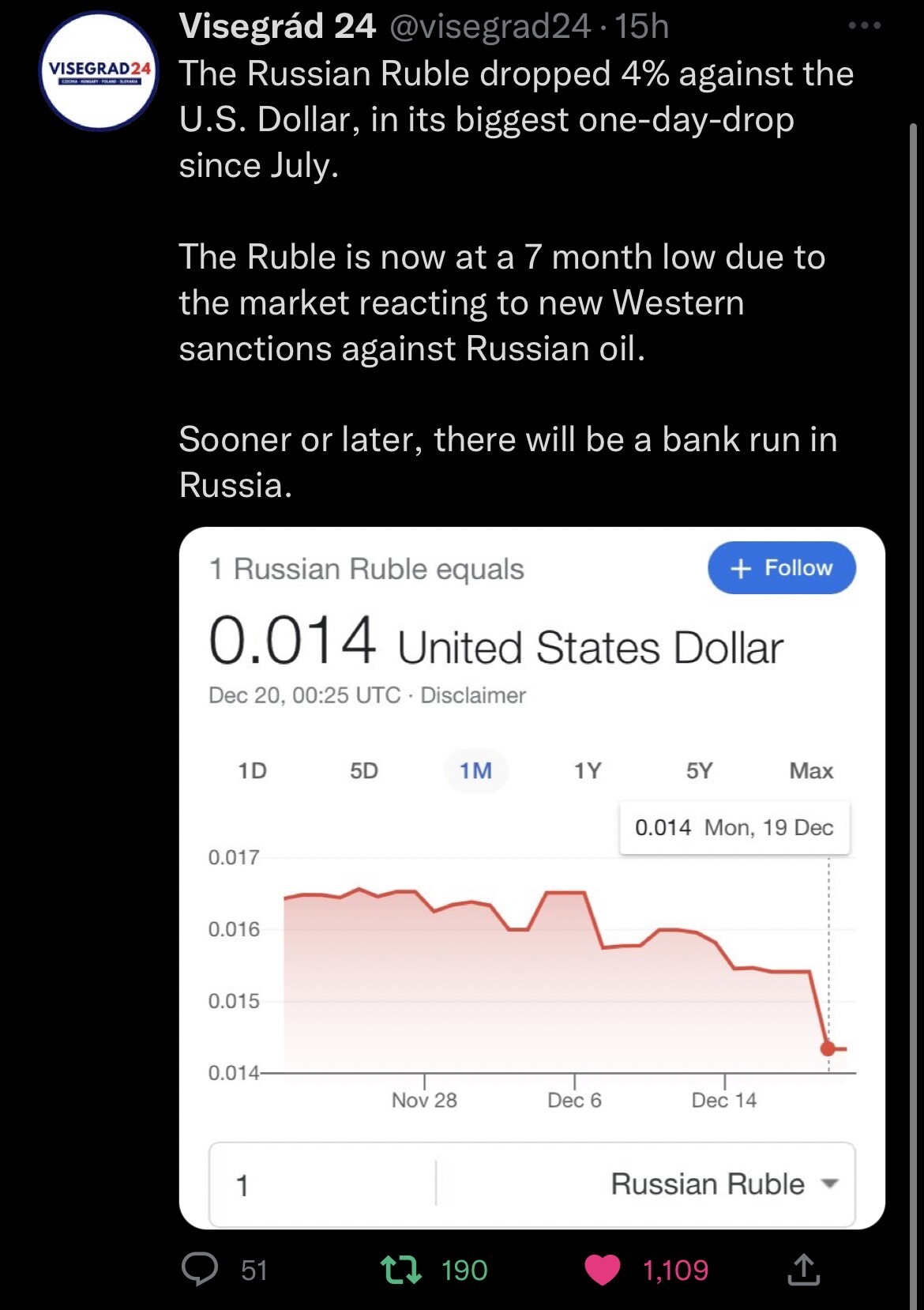

Visegrad24, a news aggregate site with several hundred thousand followers, wrote this past Monday that "The Russian Ruble dropped 4 percent against the U.S. Dollar, in its biggest one-day-drop since July. The Ruble is now at a 7 month low due to the market reacting to new Western sanctions against Russian oil. Sooner or later, there will be a bank run in Russia."

"Russians are creative about mitigating and/or circumventing sanctions. But sooner or later sanctions will start slowing down the economy. It takes a while to slow down a massive cargo ship, same with the economy," explained Oleksandr Lugovskyy, an economist living in the U.S., adding that, "but once it’s been slowed down it’s even harder to try to keep it going."

Lugovskyy's predictions about the future were equally bearish.

"I expect the Russian economy to decline at single digits. Which might not sound as much but for a relatively large economy it is a lot. Unless G7 or the U.S. + EU impose even more severe sanctions, then the decline in GDP could go into double digits."

Garry Kasparov, a Russian opposition figure, recently told Kyiv Post in an interview that Russian President Vladimir Putin may be headed towards checkmate, saying that, "Putin has miscalculated everything about this war and it is all helping to bring the end of his regime nearer.”

Kasparov sees that "Between the impending economic crisis in Russia, and the high death tolls, it would seem that he is in a quagmire which will ultimately spell his defeat – and Ukraine's victory. Once that happens, those accused of war crimes must be tried by an international court and Ukraine must receive substantial compensation for the losses it has suffered at Putin's hands."

Quite what will happen next is unclear.

However, consumer confidence in Russia has been racked by an inflation rate far higher than real salary increases, economic pressures brought on by global sanctions, and a lack of hard foreign currency to back the value of the Ruble. As 2022 comes to a close, many economists are wondering whether the Ruble can, in fact, survive one more trip around the sun.

You can also highlight the text and press Ctrl + Enter