Trends are running markedly against Ukraine this week. House Speaker Mike Johnson must put Ukraine funding on the table right now, as the situation is becoming critical. And Ukraine won't win the war without a restructuring of the Price Cap.

That's the moral of the story for this week.

Oil Prices

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

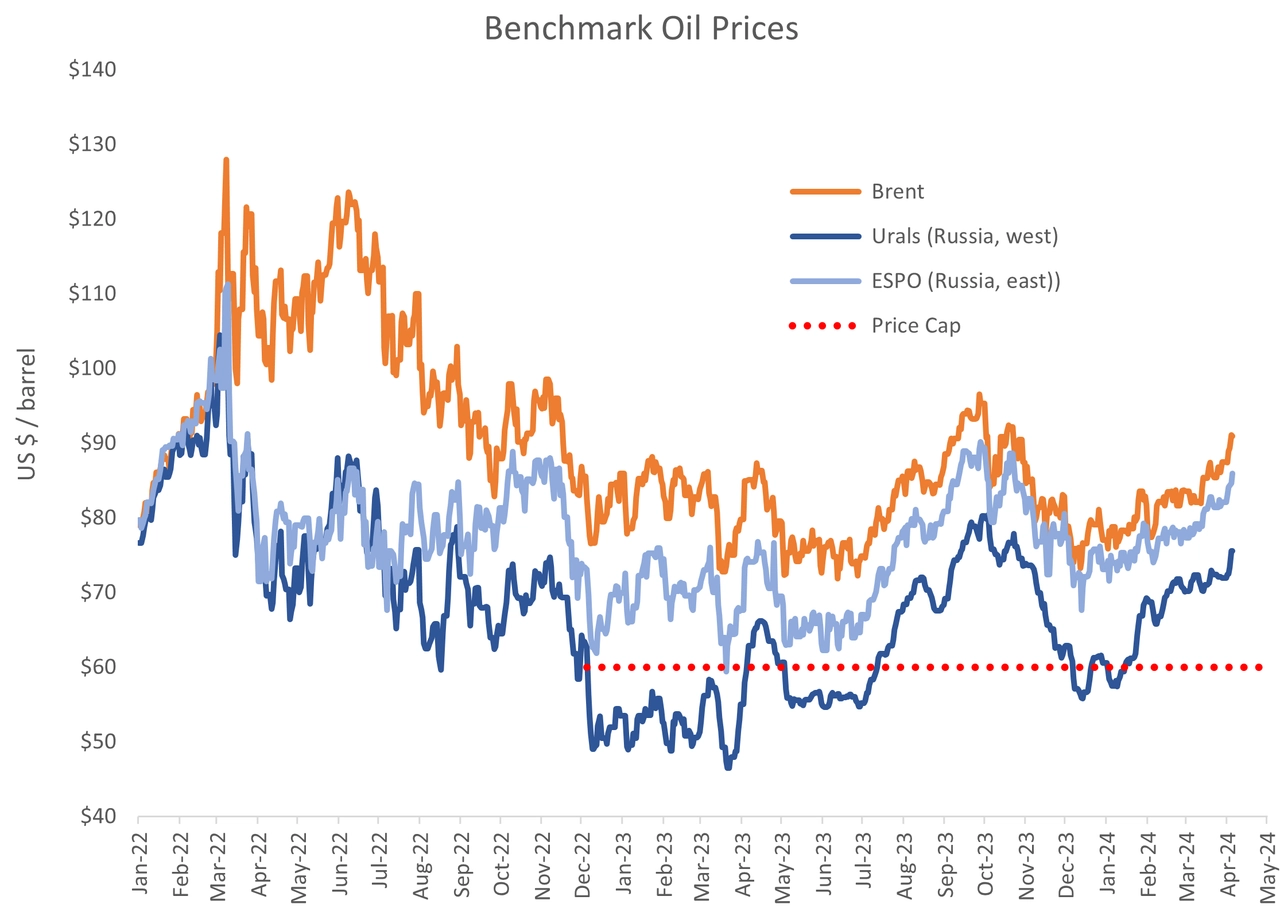

Oil prices really took off this week, with Brent closing above $91 / barrel on Friday. This is the highest since September.

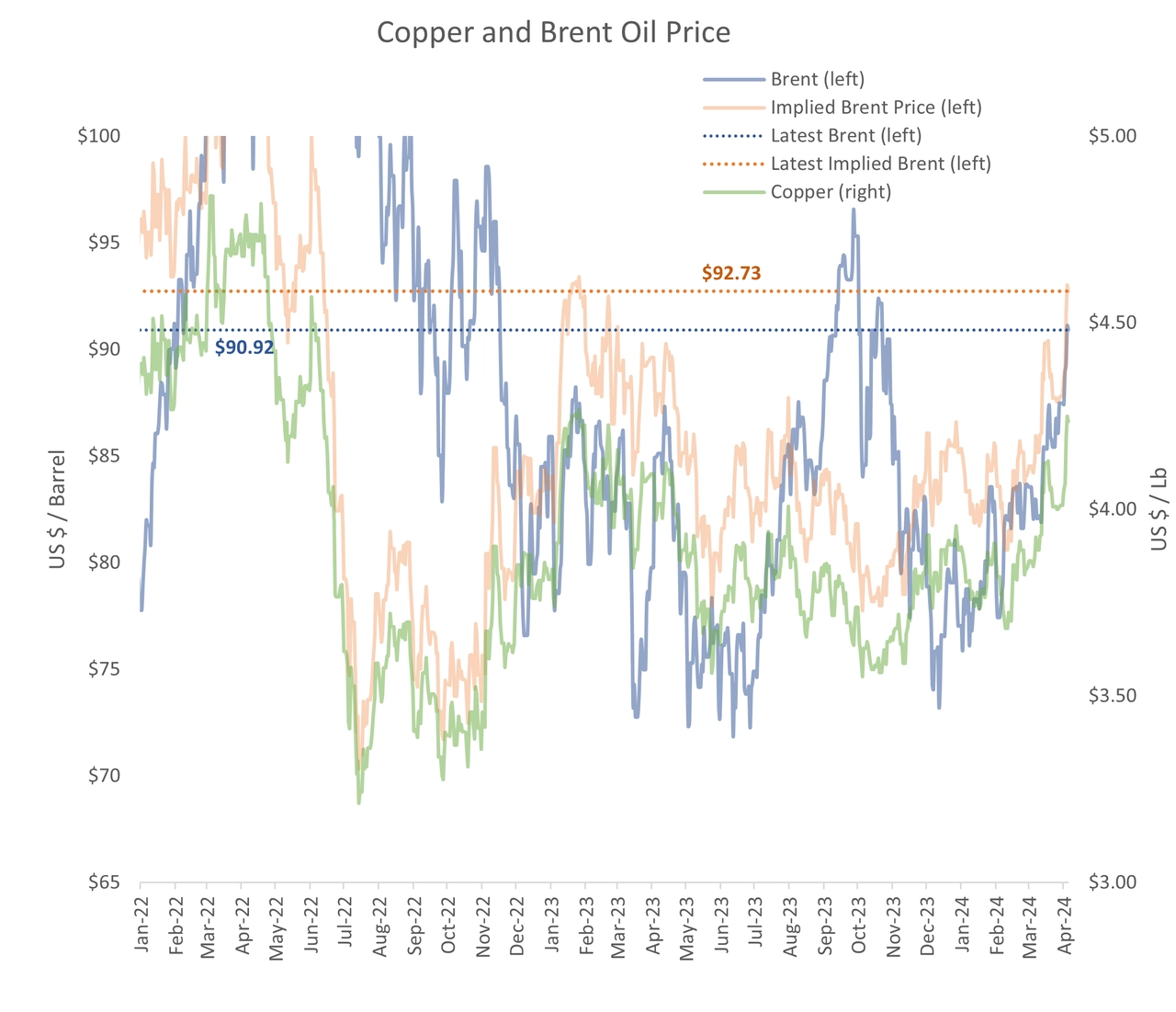

One might be tempted to attribute this wholly to Russian and OPEC+ supply production cuts, but in fact, it's not just oil. Copper has had an even better run, closing on Friday at $4.25 / lb, the highest in fifteen months.

Copper and oil covary, and as such, copper is implying the 'fair value' of Brent should be about $93. Therefore, oil seems to have some upside potential. Taken together, oil and copper are indicative of a strong global economy.

China is the exception. Iron ore and steel prices are hovering near five-year lows, although not at exceptionally low levels. Such prices are heavily influenced by Chinese real estate and infrastructure construction, and both are struggling just now.

In any event, oil prices are evolving as leading investment banks have anticipated. I would add that US shales will not come to the rescue this time, with the EIA forecasting largely flat US oil production over the next several months.

‘Europe Must Stand Up’ – EU Lawmakers Clash Over Trump’s Return, Musk’s Political Meddling

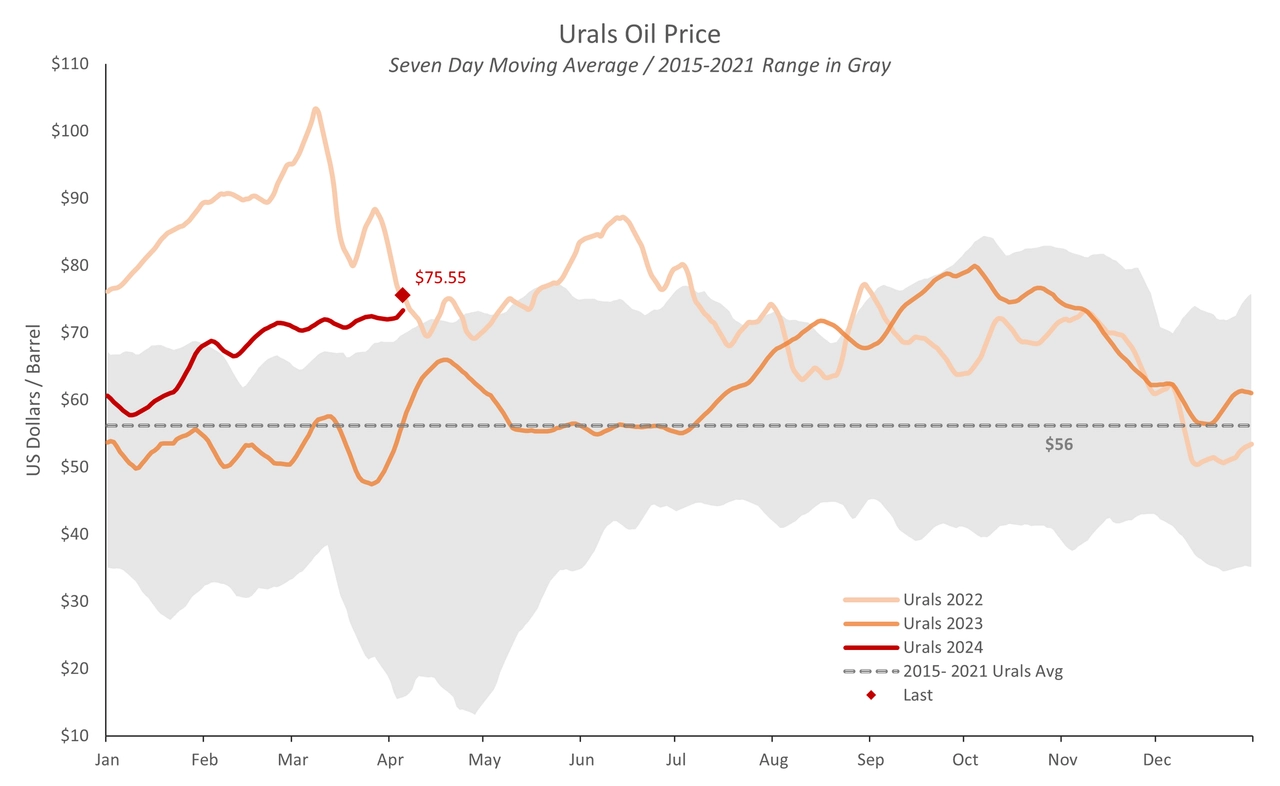

Following on the Brent rally, Russian oil prices are also showing life, with Urals closing the week above $75.

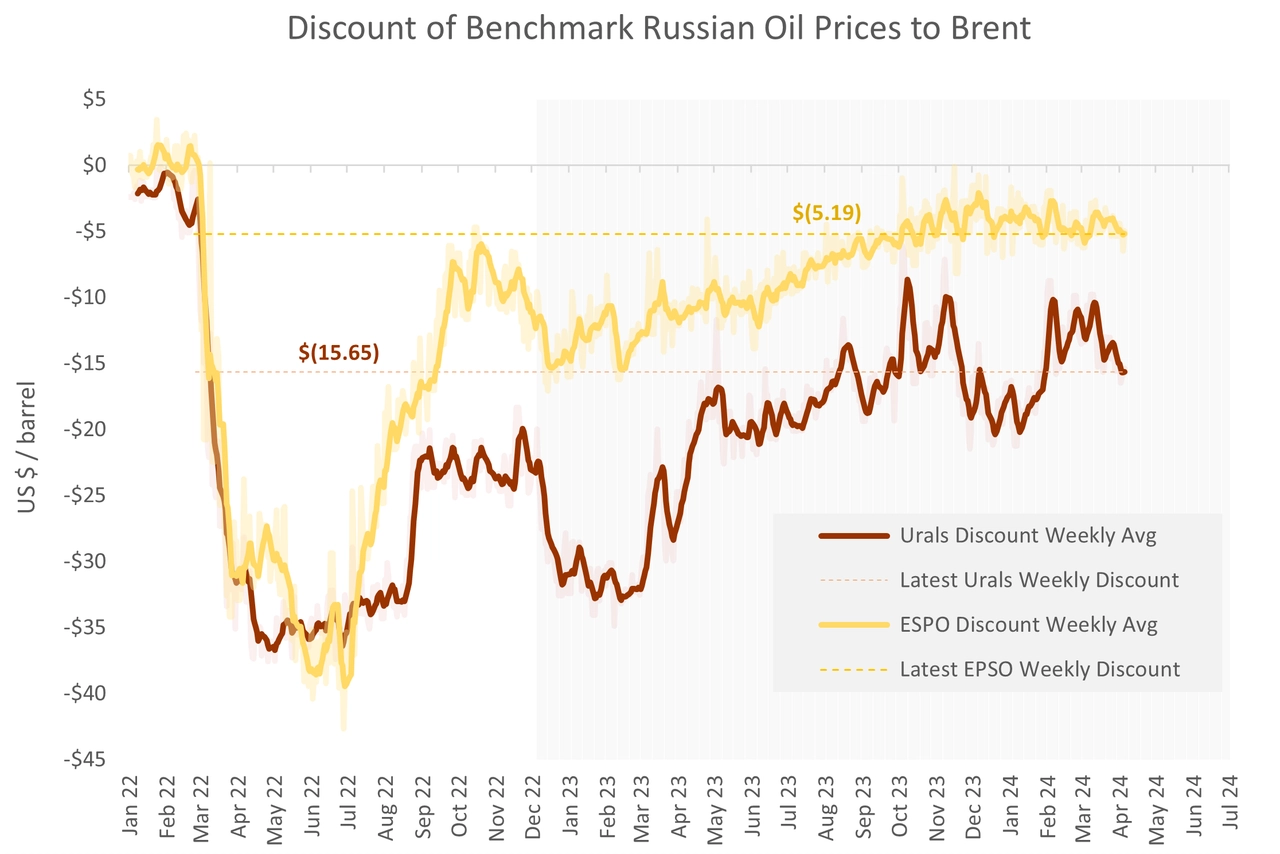

The Urals discount, the difference between Russia's Urals oil export price and Brent, averaged nearly $16 / barrel for the week. This is likely the result of delays in reporting, and we might expect the discount to close back to $14, with a tendency towards $12. Urals at $80 / barrel is within sight.

Finally, the Urals price is not only well above the $60 Price Cap and rising, it is also testing nine-year highs. This is a lousy situation for Ukraine, but entirely predictable and the direct result of poor decision-making in both Washington and Kyiv.

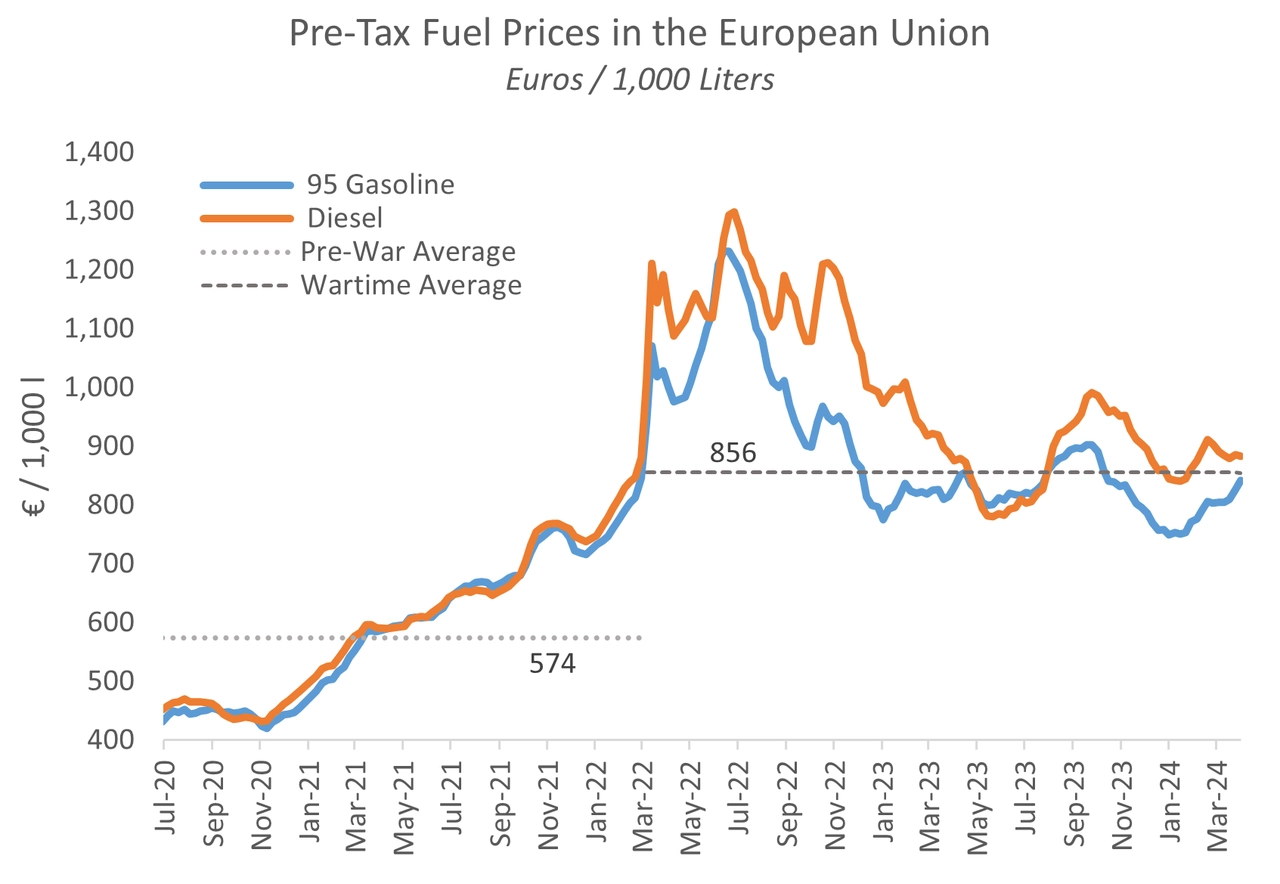

Finally, EU fuel prices appear largely unaffected by Ukraine's continuing attacks on Russian refineries. Notwithstanding, expect gasoline and diesel prices to follow crude oil prices up, as is normally the case.

So, to sum up the takeaways: While Russian and OPEC supply cuts may be lifting oil prices, they are not the only factor. A strong global economy appears equally responsible, suggesting that oil prices could continue to rise, just as a number of analysts have been forecasting. Urals is already $15 above the Price Cap and $4 / barrel above the budget numbers used by the Russian central bank. The Urals discount is likely to compress further, pushing Urals closer to $80 over the next few weeks.

Meanwhile, the Ukrainians are running low on ammo and anti-aircraft missiles, just as the Russians have developed a more effective glide bomb and reports are surfacing about a 300,000 man assault by the Russians on Kharkiv. It's now or never for Speaker Johnson on Ukraine funding; and Washington and Kyiv had better start contemplating a near-term restructuring of the Price Cap if Ukraine is to prevail.

The views expressed in this opinion article are the author’s and not necessarily those of Kyiv Post.

Read the original article here.

You can also highlight the text and press Ctrl + Enter