Kyiv’s skyline is littered with construction cranes; its residents complain of noisy construction sites. It makes one wonder if the city isn’t experiencing a residential real estate boom.

In reality, however, the number of apartment buildings going up around the city is not enough to meet the number of interested buyers looking for newer and bigger apartments. Amid this type of demand, combined with a lack of available apartments, prices are rising rapidly, and with no sign of slowing down.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

“There is a chronic shortage of apartments” in Kyiv, according to John Suggitt, founder and managing director at the Kyiv Real Estate Recovery Fund (KRER), an investment fund.

In real estate markets in more developed parts of the world, the average available apartment space per resident is about 30 to 40 square meters. In Germany, that number is closer to 45 square meters; in Ukraine, it’s 20 square meters per person, according to Kyiv city official statistics.

And despite the economic downturn caused by the pandemic, people are looking to buy.

Yuri Pita, president of the Association of Real Estate Experts of Ukraine, says the number of people wanting to buy an apartment in Kyiv has increased by more than 20% during the last six months, and the trend is likely to continue.

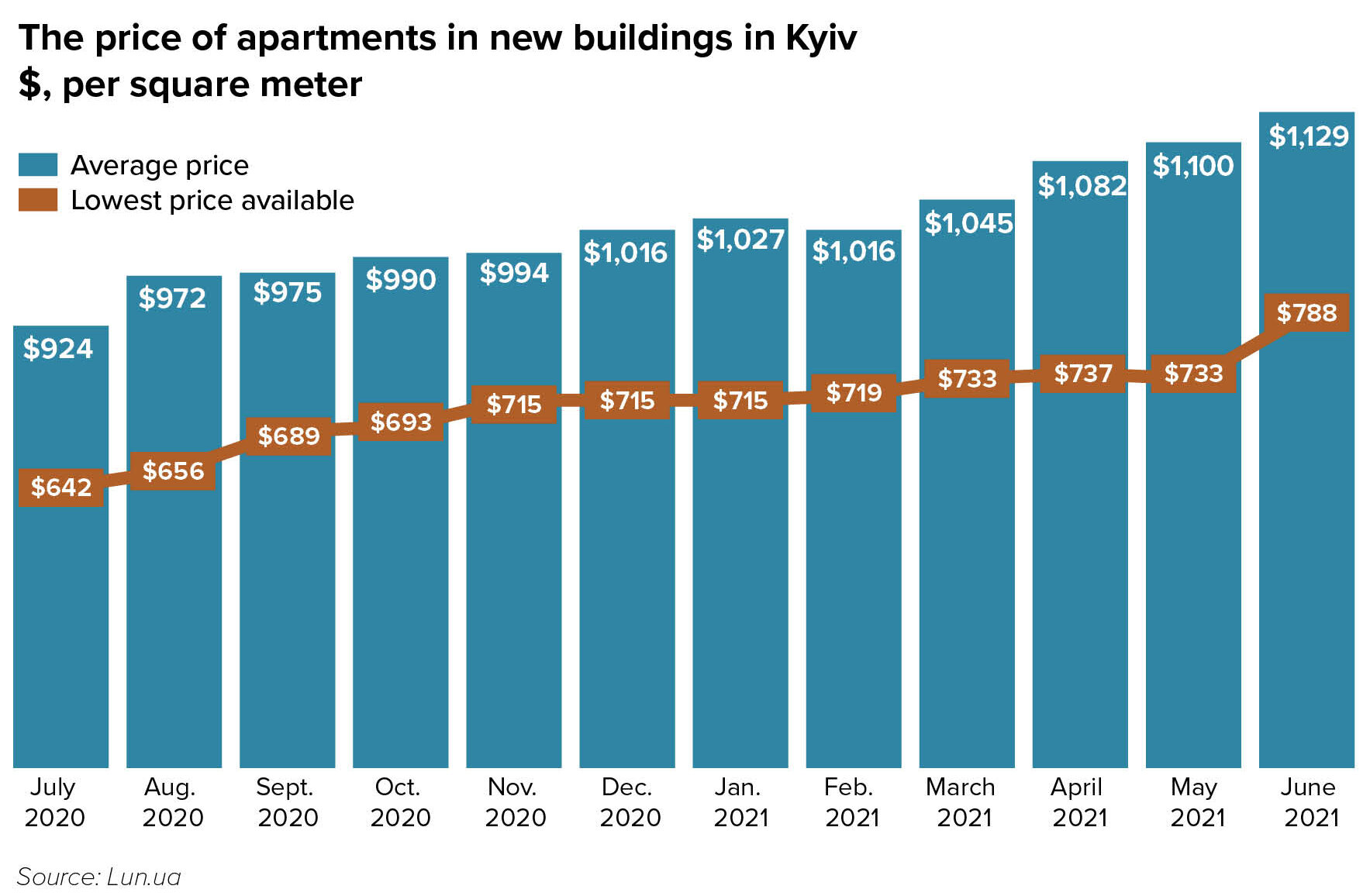

It is no surprise then that Kyiv’s apartment prices have surged by 23% in the last year, according to Lun.ua, an online marketplace for real estate. If the average cost of an apartment in Kyiv was $922 per square meter in 2020, it’s now already $1,131 a year later.

And prices are likely to keep rising. Banks are giving out more mortgages, providing buyers more opportunities to borrow; a planned increase in real estate taxes will push the prices up too.

The real estate market in Kyiv is also very sensitive, Suggitt said. “A slight increase in either the demand or supply would have “a massive impact on the price.”

Rising wages, prices

In Ukraine, where currency fluctuations are known to occur, real estate is a safe place to store savings, according to Nataliya Romanyuk, CEO of real estate agency NR Property.

According to Oleksiy Kushch, director of First Dnipro Investment Company, most apartments in Kyiv today are bought as an investment tool. That’s nothing new, but Kushch says that more Ukrainians living abroad have begun investing in Kyiv real estate.

Apartments in Kyiv provide a rental yield of 10% while some are even higher, Romanyuk said. Investors can generally expect a faster return on their investment than in countries like Germany where the average yield is 3%.

Romanyuk explained that good investment options are limited in Ukraine, but that real estate can easily be a reliable source of passive income when turned into a rental property. “It’s like insurance for your family” if all else fails, she said.

Growth in average salary is also “an excellent measure of predicting demand,” Suggitt said. Ukraine’s average wage grew by 28% from Hr 10,542 (around $388) in May 2020 to Hr 13,499 (around $496) in 2021, according to the Finance Ministry.

Along with the increased demand, the rising price of construction materials like steel and lumber is also impacting the market.

Anna Popruga, marketing director at KAN Development, says that wages demanded by workers have also risen “significantly,” making it more difficult to remain profitable.

More mortgages

The recent rise in Kyiv’s apartment prices is nothing compared to the amount it could increase with an effective mortgage lending system, according to Suggitt.

Without a loan, investors need to save $60,000 to $80,000 to buy real estate, he said. But reasonable credit would make investing in real estate affordable for more Ukrainians regardless of their income.

The government is attempting to make housing cheaper under the presidential “Affordable Mortgage 7%” program introduced in March, but it’s mainly targeted towards young families and not readily available.

Kushch said 7% is still “too expensive” for a mortgage. The cost of borrowing money would eventually add up to a substantial amount and be enough to purchase another property, he explained.

An annual mortgage rate shouldn’t exceed salary and needs to be between one to three percent, according to Kushch. This is “a normal credit for real estate,” he added. In the U.S., for example, mortgage rates are 2–3%.

In 2020, the mortgage rates in Ukraine had an average of 18% and many people didn’t even qualify for it, according to Tetyana Markova, director of sales and marketing at Kyivmiskbud, a major construction holding company of Ukraine.

But during the first quarter of 2021, banks issued a total of 1,811 mortgage loans that added up to Hr 1.4 billion ($51.4 million), according to the National Bank of Ukraine. Both the number of agreements signed and the monetary value have doubled from the same period last year.

Tax hike underway

Along with the rising demand, there is a plan to increase the tax on the sale of real estate in the upcoming months. Lev Partskhaladze, president of the Confederation of Builders of Ukraine, predicts that the new taxes would increase the housing prices by up to 40%.

The parliament has already adopted the first reading of the new bill on July 1, which includes raising taxes on the real estate market.

As of now, the 20% value-added tax is only charged during the first sale of a property. The VAT exemption on apartments that have already been purchased once will be gone when the new tax legislation is introduced.

The controversial bill puts an additional burden on those involved in buying and selling apartments as investments. Under the new bill, selling three or more properties in a year will be subject to 18% income tax instead of the current 5%.

Finance Minister Sergii Marchenko said this is to combat the use of VAT exemption in secondary residential sales market to minimize the taxes paid. He promised that it would not have a significant impact on real estate prices but experts in the field disagree.

“Very small effects in Kyiv’s market can have very large impacts on the price and that’s exactly why I invest here,” Suggitt said.

You can also highlight the text and press Ctrl + Enter