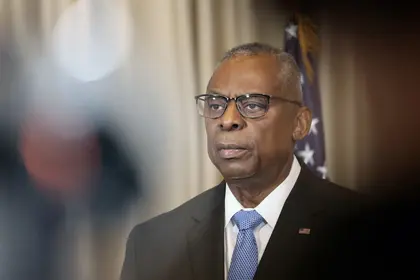

US Defense Secretary Lloyd Austin said Ukraine’s recent drone strikes on Russian oil refineries have a “knock-on effect” that could affect the global energy situation and suggested Kyiv focus on “tactical and operational targets” instead.

“Those attacks could have a knock-on effect in terms of the global energy situation. Ukraine is better served in going after tactical and operational targets that can directly influence the current fight,” Austin told the Senate Armed Services Committee on Tuesday, April 9, Bloomberg reported.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

Republican Senator Tom Cotton rebuffed Austin’s comments and said they were made for political reasons and discouraged effective Ukrainian actions.

“It sounds to me that the Biden administration doesn’t want gas prices to go up in an election year,” Cotton said.

Austin’s comments are the latest confirmation of Washington’s position on Ukrainian drone strikes on Russian refineries, which first started circulating following a Financial Times (FT) article – citing unnamed officials – that said Washington had relayed wishes to Ukraine’s intelligence units to stop hitting Russian oil refineries for fear of rising crude prices and retaliation.

Sources quoted in the FT report also alleged the Biden administration feared domestic unrest resulting from rising oil prices that could impact current US President Joe Biden’s chances of being re-elected.

N. Korean Troops Massed in Russia to Enter Ukraine War ’Soon’: Pentagon Chief

Following the FT report, Spokesperson for the US Department of State Matthew Miller reiterated Washington’s stance that it “[does] not encourage or support Ukraine taking strikes outside its own territory” while refusing to comment on “specific conversations,” hinting that Washington was not supportive of Kyiv’s refinery strikes.

Since January, Ukraine has started to strike dozens of Russian oil refineries deep behind the front line with domestically produced drones in an attempt to curb the revenues generated by oil sales Moscow has been using to finance its war in Ukraine, all amidst the ongoing munition shortage suffered on the front in part caused by the stalled US military aid.

The West has attempted to introduce a price cap on Russian crude sales at the early stages of Moscow’s full-scale invasion to deprive it of oil-related income but to no great effect, where Moscow managed to net $11.3 billion through oil exports in October 2023 – surpassing pre-war levels – that prompted Washington to step up the sanction measures.

According to Bloomberg, Russia’s crude exports by sea in the first week of April have dropped from the year-to-date high at the end of March due to issues relating to exports through its Baltic ports, where volumes at the Primorsk and Ust-Luga ports declined by approximately 20 percent.

“The pullback followed a surge in flows from those ports in the final two weeks of March amid the Ukrainian drone strikes on refineries, which may have diverted crude into exports rather than processing,” Bloomberg reported.

In a recent Kyiv Post OpEd, strategic management consultant and investment banker Steven Kopits said that Ukrainian strikes are not driving up crude prices, and that other factors were at play that ultimately drove up oil prices, and the answer might lie in a “much needed and vastly overdue restructuring of the price cap.”

“If the crude is not refined in Russia, it will simply be exported as crude and refined elsewhere,” Kopits said.

You can also highlight the text and press Ctrl + Enter