We analyze legislative innovations and regulations that come into force at the beginning of the new year

Ukrinform has compiled a traditional selection of innovations that start counting down from the first day of the new year. Most of them are due to the entry into force of the country's main financial document - the Law "On the State Budget of Ukraine for 2024." This year's expected budget revenues are UAH 1.7 trillion, planned expenditures are UAH 3.3 trillion, and the deficit limit is UAH 1.6 trillion. So.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

WAGES AND SOCIAL ASSISTANCE

- The minimum wage will be UAH 7100 starting January 1, and UAH 8000 starting April 1.

This will, among other things, affect the amount of taxes and fees for businesses tied to the minimum wage and the subsistence level.

In particular, unemployed Ukrainians who have reached the age of 65 and have a full insurance record (30 years for women and 35 years for men) will be entitled to recalculate their pensions. According to part 2 of Article 28 of the Law of Ukraine "On Compulsory State Pension Insurance", the minimum amount of payments for such pensioners cannot be less than 40% of the minimum wage. From now on, it will be UAH 2,840.

In addition, the amount of monthly cash payments to people who have rendered special services to the Motherland will increase (Law of Ukraine "On Monthly Cash Payments to Certain Categories of Citizens").

At the same time, clause 9 of the Final Provisions of the State Budget Law stipulates that the recalculation of pensions, allowances, increases and other pension supplements, which is carried out taking into account the subsistence minimum for disabled persons established as of January 1, 2024, will be carried out from March 1, along with the annual indexation of pensions.

Brussels Hopes to Advance Ukraine, Moldova Entry Talks in 2025

As a reminder, the Ministry of Social Policy of Ukraine has denied rumors about the possible abolition of annual pension indexation in 2024 and alleged disruptions in payments in the event of a restriction on international financial assistance.

- The subsistence minimum (general indicator) will amount to UAH 2920 from January 1 (compared to UAH 2589 in 2023).

In particular, for children under the age of 6, it will be UAH 2563, for those aged 6 to 18, UAH 3196, for able-bodied persons, UAH 3028, and for persons who have lost their ability to work, UAH 2361. Accordingly, the pension supplement for honorary donors of Ukraine will increase from UAH 258.9 to UAH 292 (10% of the subsistence level).

-

The annual income limits for individual entrepreneurs are also changing, which is the threshold above which an entrepreneur can be transferred to the general taxation system. The limit for the simplified taxation system group 1 will increase to UAH 1,185,700 (167 times the minimum wage); for group 2 - UAH 5,921,400 (834 times the minimum wage); for group 3 - UAH 8,285,700 (1,167 times the minimum wage).

-

The minimum salary of public sector employees, which depends on the salary of an employee of the 1st tariff category of the Unified Tariff Scale, will also change: from January 1 - to UAH 3,195, and from April 1 - to UAH 3,600.

Advertisement

Separately, the government announced a 21% increase in teacher salaries in 2024. This will take place in two stages: from January 1, a 10% increase is envisaged, and from April 1, another 12.6%. On average, a teacher should receive UAH 16,000 this year. The average monthly salary of a teacher of the highest category will increase to UAH 17,400.

Payments to persons engaged in community service from the Employment Center will increase to UAH 7,100-10,650 per full month worked (in 2023, it was UAH 6,700-10,050).

-

Starting from January 1, employers will receive more compensation for the arrangement of workplaces for people with disabilities. When employing a person of Group I, it will be UAH 106.500(15 minimum wages), and Group II - UAH 71,000 (10 minimum wages).

TAXATION OF INDIVIDUAL ENTREPRENEURS

For individual entrepreneurs of the 1st group:

Single tax - UAH 302.80 per month (10% of the subsistence minimum for able-bodied persons as of January 1).

Unified social contribution rate (for yourself):

- from January 1 - UAH 1562 per month (22% of the minimum wage);

- from April 1 - UAH 1760 per month (22% of the minimum wage).

Taxes for individual entrepreneurs of the 2nd group:

Single tax - UAH 1420 per month (20% of the minimum wage).

Unified social contribution rate (for yourself):

- from January 1 - UAH 1562 per month (22% of the minimum wage);

- from April 1 - UAH 1760 per month (22% of the minimum wage).

Taxation of individual entrepreneurs of the 3rd group:

Single tax - 5% of income, or 3% of income + VAT.

Unified social contribution rate (for yourself):

- from January 1 - UAH 1562 per month (22% of the minimum wage);

- from April 1 - UAH 1760 per month (22% of the minimum wage).

Taxation of individual entrepreneurs of the 4th group (farms):

The rate of the Single Tax per hectare of agricultural land or water fund land depends on the category (type) of land, location (as a percentage of the tax base).

Unified social contribution rate (for yourself):

- from January 1 - UAH 1562 per month (22% of the minimum wage);

- from April 1 - UAH 1760 per month (22% of the minimum wage).

RESTORATION

-

Starting January 1, those who have previously made repairs to their homes damaged by the aggressor will also receive compensation for their own expense.

To receive compensation, you need to:

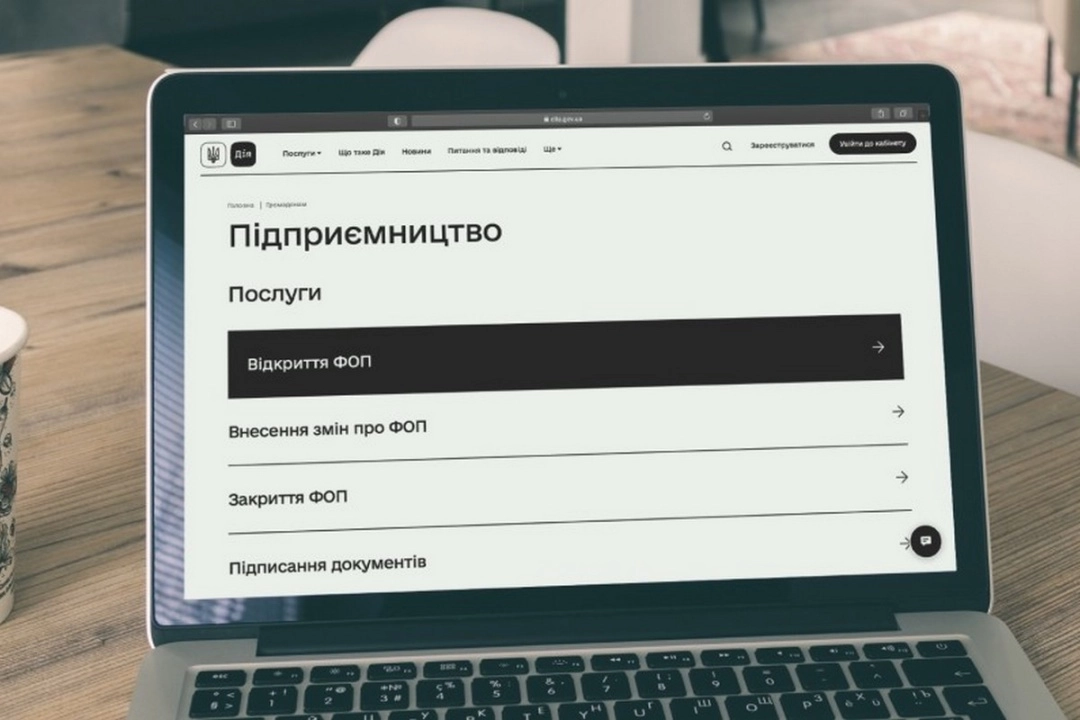

- submit an application through Diia;

- wait for the application to be reviewed by a special commission that will determine the amount of compensation.

When making a decision, the commission takes into account the data from the act of initial inspection of the damaged housing and documents on the construction materials spent on repairs, taking into account the list of the cost of materials and works approved by the Cabinet of Ministers.

-

In addition, applications for reimbursement of the cost of lost or damaged housing are being accepted through ASCs and Diia. The authorities also announced that in 2024 a new type of compensation may appear - for housing damaged during a full-scale war in the territories temporarily uncontrolled by Ukraine.

As a reminder, on May 10, 2023, the government program "eRestoration" was launched, under which people can receive compensation (up to UAH 200,000) for the repair of damaged housing. On December 27, the first compensation payments for destroyed housing started.

In total, Ukraine has allocated UAH 20 billion for such compensation. More than 100,000 people are expected to receive the money.

LAND REFORM

On January 1, the second stage of the land reform will start, when legal entities registered in Ukraine will be able to buy land. They will be able to purchase no more than 10,000 hectares of agricultural land. The law on the land market prohibits foreigners from buying land.

MISCELLANEOUS

-

Starting January 1, non-bank financial institutions must disclose all terms and conditions of consumer lending (including the functionality of loan calculators) on their websites and in advertising.

-

The requirement to gradually limit the maximum interest rate on microloans to 1% per day (the process is extended for 8 months) is included.

-

Fees for obtaining a driver's license and car registration are increased. In particular, the cost of services in the service centers of the Ministry of Internal Affairs is increasing.

So from now on, one will have to pay UAH 230 for a driver's license (previously UAH 26), UAH 250 for a theoretical exam (previously UAH 13), and UAH 420 for a practical exam (instead of UAH 13).

Registration, re-registration of vehicles of all categories with the issuance of a physical or electronic certificate and with the assignment of a license plate (with or without issuance), as well as deregistration of a car with the provision of an accounting card and license plates for one-time trips, will cost 350 instead of UAH 200.

-

Another 50 complexes for automatic recording of traffic offenses will be launched on Ukrainian roads. Of these, 19 systems were in operation before the full-scale invasion and will now resume their work, and 31 more will be operational for the first time. For more information on the geography of the control devices, see here.

You can also highlight the text and press Ctrl + Enter