While the public in all likelihood wanted no reminding, the Ukrainian government has made certain to inform its citizens that their income taxes will be going up at the start of next year. Experts, however, don’t expect the rise to have much of an effect on how the population pays, or avoids paying, the state its due.

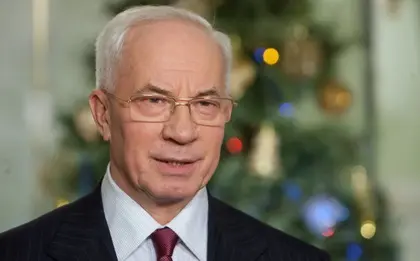

First Deputy Prime Minister and Finance Minister Mykola Azarov announced Sept. 19 that the tax rate on personal incomes will increase from the current flat rate of 13 percent to 15 percent starting in 2007, in line with the income tax law adopted in 2003.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

The flat rate, which went into effect at the beginning of 2004, replaced a progressive tax rate of 10 to 40 percent based on individuals’ income levels. The 2003 law provided the 13 percent flat tax as a transitional rate from the old progressive rate system for a two-year period, before imposing the 2 percent increase in 2007.

According to tax specialists, the 2003 tax reform was largely aimed at bringing people’s incomes out of the shadows.

However, with employers shouldering the personal income tax in addition to other taxes as a percentage of their employees’ salaries, specialists say the goal of the reform has not been met very successfully.

As a result of Ukraine’s still complicated and cumbersome tax system – often cited as a major reason why foreign investors avoid the country – specialists say that employers continue to declare lower official salaries to the authorities for tax purposes while paying their employees higher salaries under the table.

Ksenya Lyapina, the head of the Council of Entrepreneurs under the Cabinet of Ministers, said that the 2 percent increase is unlikely to influence the size of people’s salaries, much as the 2003 reform didn’t influence them either.

“Employers carry a tax burden in addition to the 13 percent income tax, paying taxes to the social contribution fund,” Lyapina said.

According to Ukraine’s tax legislation, employers currently pay 36 percent of their employees’ salaries to a social fund used for pensions, workers compensation, etc. In addition, employers contribute to a social insurance fund, the rate of which varies from 0.67 percent to 2.5 percent.

As a result, employers currently pay up to 51 percent of their employees’ salaries, and starting in January, that rate will be as high as 53 percent, according to Lyapina.

“Therefore, they [employers] prefer to pay low salaries officially, and market-based salaries in envelopes,” she said, adding that the 2 percent tax increase is unlikely to affect what people are paid in the workplace.

“It’s well known that people really have incomes double those that are declared,” she said.

According to official State Statistics Committee data, the average salary earned in Ukraine is currently about $200 a month, and $300 for those employed in the capital Kyiv.

In terms of the actual taxation rate, Jorge Intriago, a partner with PricewaterhouseCoopers in Kyiv, said that the 15 percent income tax rate is reasonable for Ukraine.

“Ukraine’s personal income tax still remains lower than the average flat tax rate in Central and Eastern European countries, which is 18-20 percent. The only lower rates are in Georgia – 12 percent, Russia – 13 percent, and Serbia – 14 percent,” Intriago said.

According to Intriago, in Ukraine, a flat personal income tax rate of 15 percent is an improvement on the previous progressive tax rate, since individuals are no longer subject to taxation potentially as high as 40 percent of their incomes.

“We do not expect any negative impact out of such an increase [of 2 percent], as it was predictable and it isn’t big,” Intriago said.

He added, however, that Ukrainians are still not accustomed to paying taxes, as a taxpaying culture has not yet developed in the country. In such a climate, Intriago said, people are more likely to try to hide their real incomes in the face of a high tax rate.

“I believe that the 15 percent tax rate is appropriate for Ukraine and it shouldn’t be increased in the near future,” he said. “Of greater importance is the need to reduce the social contributions [that employers pay] to a more realistic level. A reduction to 20-25 percent would significantly increase the level of [tax] collection.”

You can also highlight the text and press Ctrl + Enter